49+ can you deduct rental property mortgage payments

Web If you itemize your deductions on Schedule A of your 1040 tax form you can deduct the mortgage interest and property taxes youve paid. Find A Lender That Offers Great Service.

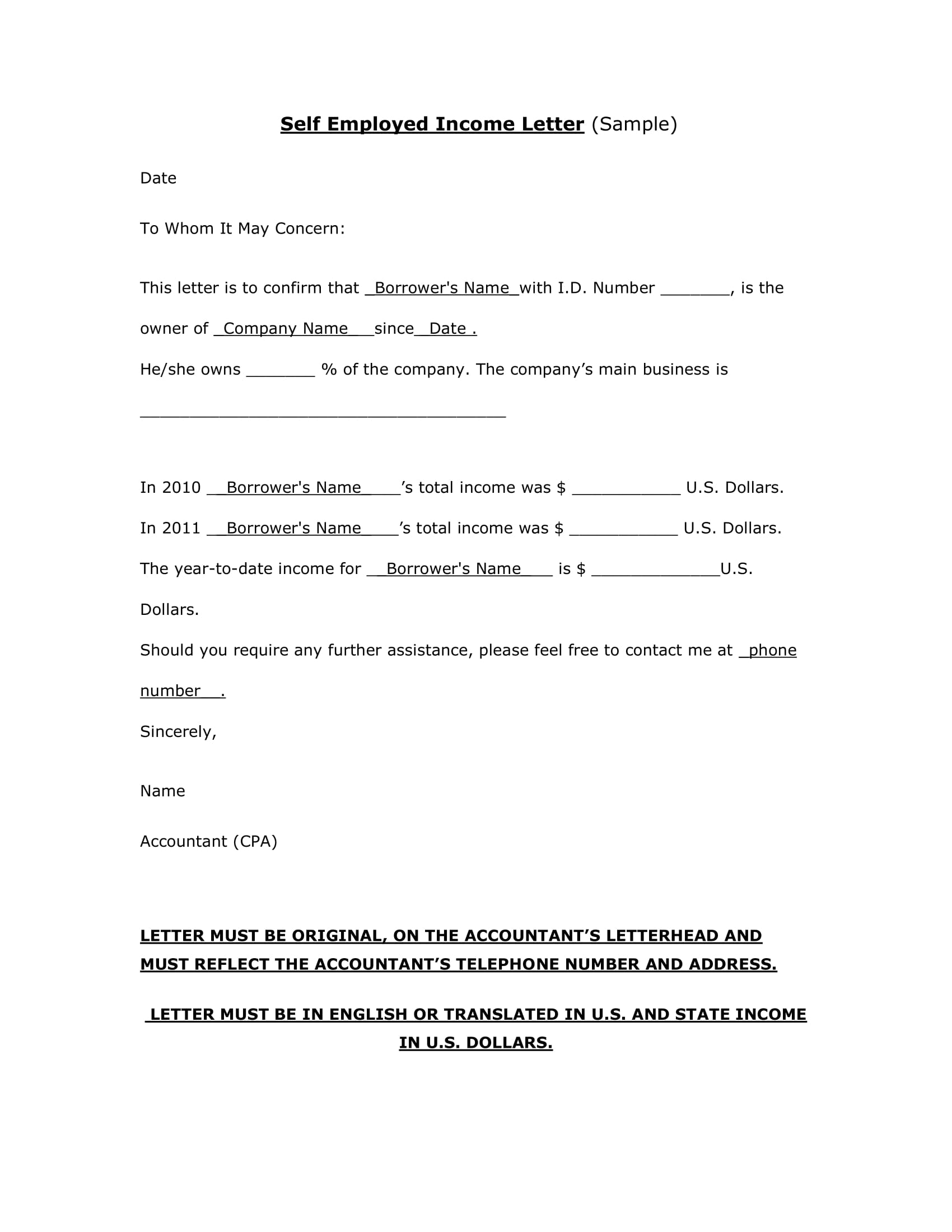

Income Verification Letter 9 Examples Format Sample Examples

Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal.

. However you can deduct the mortgage interest and real estate taxes that you paid for. Web Should that owner have a rental income of 36000 taking a 16000 deduction for the mortgage interest reduces their taxable rental income to 20000a. These include insurance utilities advertising travel expenses and supplies used to keep.

You can deduct rent if you live in a state that allows it. In fact if you meet the. Web You cannot deduct principal mortgage payments from your income whether your real estate property is your primary residence or a rental property.

Web Paying off the mortgage principal isnt a deductible expense -- all you can claim is the interest. However if you prepay the premiums for more than one year in advance for. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property.

Web How to deduct mortgage interest on federal tax returns When you file taxes you can take the standard deduction or the itemized deduction. Ad Compare Your Options With Our Easy-to-Use Mortgage Payment Calculator. Web You also can deduct normal expenses incurred from operating and managing the property.

Get an Expert Opinion2nd Opinion. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Web To deduct PMI from your 2020 taxes you must meet the criteria for claiming home mortgage interest.

If you do you can probably deduct the full amount of PMI. Web As a rental property owner there are several expenses that you can deduct from your taxes to save you money and improve your overall operation. If that makes your rental a cash drain instead of a cash cow the IRS cant help.

Get Access to the Largest Online Library of Legal Forms for Any State. Web Answer In general you can deduct mortgage insurance premiums in the year paid. Web If youre wondering whether you can deduct your rent on your taxes the short answer is yes.

Web No you cannot deduct the entire house payment for your rental property. Ad Dont Take Chances w the Law. Compare More Than Just Rates.

Rental Property Calculator Most Accurate Forecast

424h

What Will Be The In Hand Salary For A 35 5 Lpa Ctc Quora

If The Ctc Is 75 Lpa What Is The In Hand Salary Quora

Business Succession Planning And Exit Strategies For The Closely Held

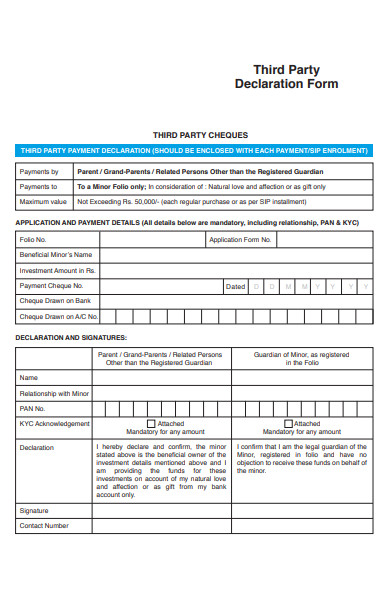

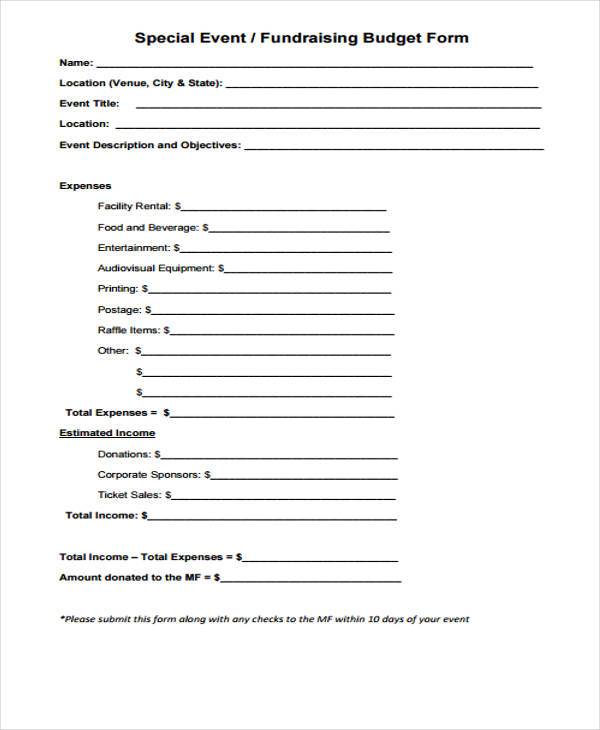

Free 49 Party Forms In Pdf Ms Word Excel

What Is The In Hand Salary If Ctc Is 12 Lpa And Opted For A New Regime Quora

Income Verification Letter 9 Examples Format Sample Examples

Vacation Home Rentals And The Tcja Journal Of Accountancy

Pdf Families Incomes And Jobs

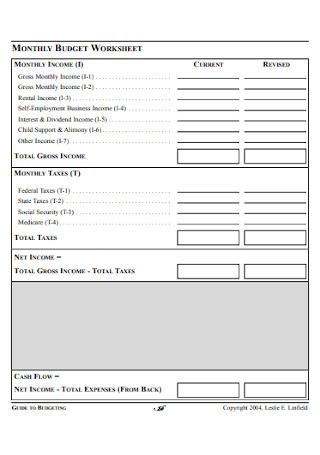

49 Sample Monthly Budgets In Pdf Ms Word

Kaiserslautern American May 29 2020 By Advantipro Gmbh Issuu

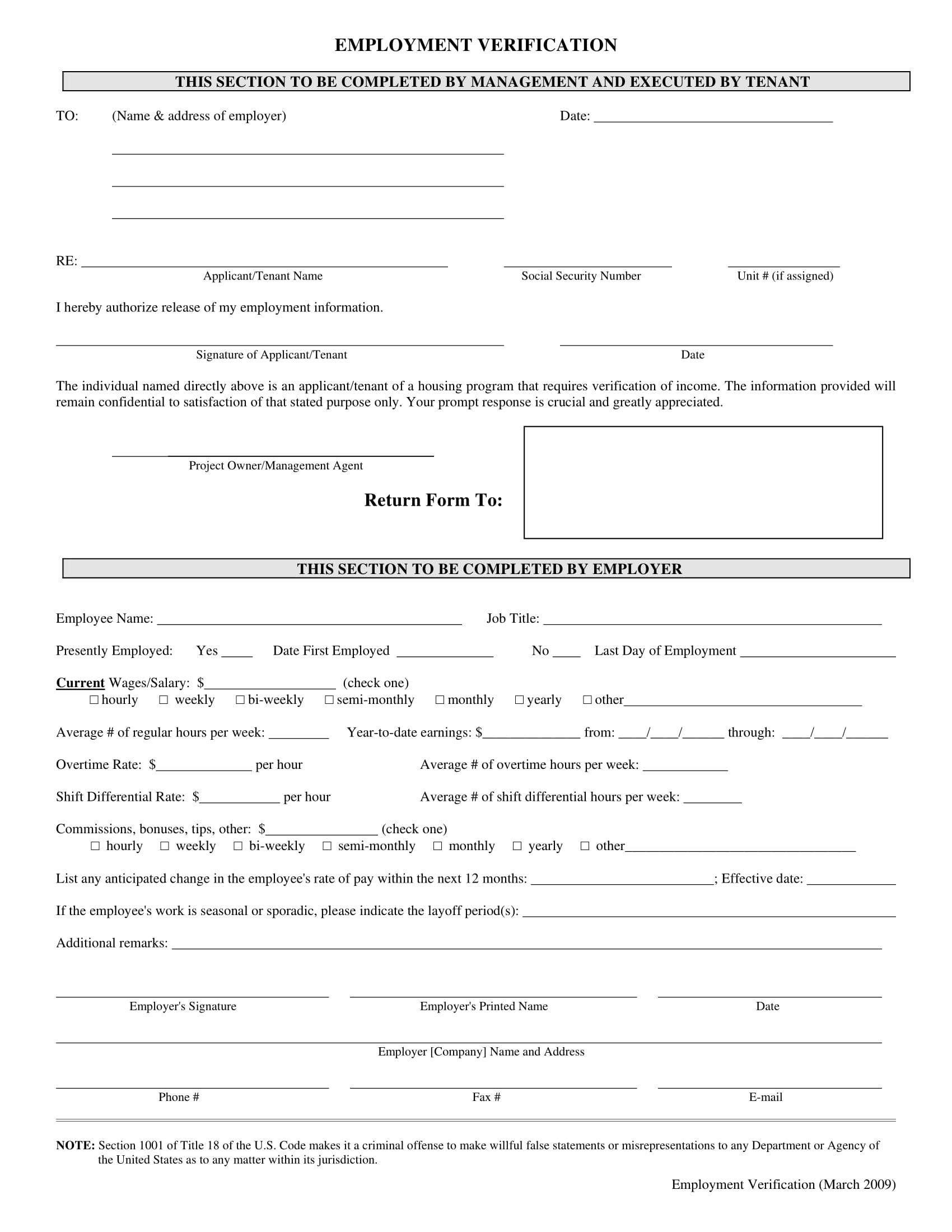

Is Mortgage Payment For Rental Tax Deductible Fox Business

Can You Write Off Loan Payments From A Rental Property

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Free 49 Budget Forms In Pdf Ms Word Excel

Buy To Let Mortgage Interest Tax Relief Explained Which